#Best Offshore Company formation service

Explore tagged Tumblr posts

Text

Best Countries for Offshore Company Formation in 2023

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company formation has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. In this blog, we will explore the best countries for offshore company formation in 2023.

Singapore

Singapore has long been a popular destination for offshore company formationdue to its favorable tax system, political stability, and a strong economy. Singapore offers a wide range of business structures, including the private limited company (Pte Ltd), which provides limited liability protection and greater credibility with customers and suppliers.

In addition to its tax advantages, Singapore offers a highly developed financial infrastructure, a skilled workforce, and a business-friendly regulatory environment. Setting up a company in Singapore is relatively straightforward, with a minimum paid-up capital requirement of just SGD 1. Moreover, the government offers various incentives for new businesses, such as tax breaks and funding programs.

How to Register an Offshore Company in Singapore?

Step 1: Choose a company name and business activity The first step in setting up an offshore company in Singapore is to choose a unique name for your business. The name must not be identical or similar to any existing registered company name in Singapore, and it must comply with the relevant regulations. You will also need to decide on the nature of your business activity, which will determine the relevant business license or permit requirements Step 2: Engage a professional services firm To register an offshore company in Singapore, you will need to engage the services of a professional services firm, such as a corporate service provider (CSP) or a law firm. These firms can provide expert guidance on the registration process, assist with the necessary paperwork and documentation, and ensure compliance with local regulations. Step 3: Choose a business structure The next step is to decide on the most appropriate business structure for yourcheapest offshore company formation offers several business structures, including sole proprietorship, partnership, limited liability partnership (LLP), and private limited company (Pte Ltd). Most offshore companies in Singapore opt for the Pte Ltd structure, which offers limited liability protection and greater credibility with customers and suppliers. Step 4: Register your company with the Accounting and Corporate Regulatory Authority (ACRA) Once you have chosen your company name, engaged a professional services firm, and decided on your business structure, you can register your company with the Accounting and Corporate Regulatory Authority (ACRA). The registration process involves submitting the necessary paperwork and documentation, such as the Memorandum and Articles of Association, details of the company's shareholders and directors, and the company's registered address. Step 5: Apply for business licenses and permits Depending on the nature of your business activity, you may need to apply for one or more business licenses or permits. Some common licenses and permits required in Singapore include a business license, employment pass, and goods and services tax (GST) registration. Your professional services firm can guide you on the necessary licenses and permits and assist with the application process. Step 6: Open a corporate bank account Finally, you will need to open a corporate bank account in Singapore. Singapore offers a wide range of local and international banks, and it is advisable to shop around to find the best account for your business needs. To open a corporate bank account, you will need to provide the necessary documentation, such as your company's registration certificate, a copy of the company's Memorandum and Articles of Association, and proof of identity and address for the company's directors and shareholders.

In Conclusion, registering an offshore company in Singapore certainly could be a straightforward and streamlined process if you follow the necessary steps and meet the relevant requirements. By engaging a professional services firm, choosing the right business structure, and complying with local regulations, you can establish a successful offshore company in Singapore and take advantage of its favorable tax system, political stability, and a strong economy.

Benefits of Registering an Offshore Company in Singapore?

Tax Benefits One of the most significant benefits of registering an offshore company in Singapore is the favorable tax system. Singapore has a territorial tax system, which means that only income earned within Singapore is taxed. Offshore companies that are registered in Singapore are exempted from paying taxes on foreign-sourced income that is not remitted to Singapore. The tax rate for companies is also relatively low, with the current rate being 17%. 2) Political Stability Singapore is known for its political stability and sound governance. This creates a favorable environment for businesses to operate in. The government is supportive of foreign investment and has implemented policies to attract businesses to the country. This means that offshore companies registered in Singapore can operate without any political instability or interference. Easy Company Registration Process The process of registering an offshore company in Singapore is straightforward and efficient. The government has streamlined the registration process, and it can be completed within a few days. The process involves submitting the necessary documents, such as the company's memorandum and articles of association, and the appointment of a local director. Singapore's business-friendly policies make it an attractive destination for entrepreneurs looking to start a business quickly. Strategic Location Singapore's strategic location in Southeast Asia makes it an ideal location for businesses looking to expand their operations in the region. The country is well-connected to major Asian markets, such as China and India, and has excellent air and sea links. This makes it easy for offshore companies registered in Singapore to access markets and customers in the region. Protection of Intellectual Property Singapore has a robust legal system that protects intellectual property rights. The country is a signatory to several international conventions, such as the World Intellectual Property Organization (WIPO) and the Paris Convention for the Protection of Industrial Property. This means that offshore companies registered in Singapore can benefit from strong protection of their intellectual property. Access to Skilled Labor Singapore has a highly skilled and educated workforce. The country's education system is world-renowned, and many of its graduates are sought after by multinational companies. Offshore companies registered in Singapore can tap into this pool of skilled labor, which can help them operate efficiently and effectively. Excellent Infrastructure Singapore has world-class infrastructure, including modern transportation, telecommunications, and utilities. This makes it easy for offshore companies to conduct their business operations smoothly and efficiently.

Hong Kong

Hong Kong is another popular offshore company formation destination due to its low tax rates, strategic location, and open economy. Hong Kong has a simple and transparent tax system, with a corporate tax rate of just 16.5% and no tax on foreign-sourced income. Hong Kong also has a highly developed financial system, making it an attractive location for businesses in the financial sector.

Hong Kong has a reputation for being one of the easiest places to do business, with a highly efficient and transparent regulatory environment. The incorporation process is relatively straightforward, and the government offers various support services for new businesses, such as funding and mentorship programs.

How to Register an Offshore Company in Hong Kong?

Step 1: Choose a Company Name The first step in registering an offshore company in Hong Kong is to choose a company name. The name must not be identical to any existing Hong Kong company name, and it must not be offensive or misleading. You can check the availability of your desired company name on the Hong Kong Companies Registry website. Step 2: Choose the Type of Company Hong Kong offers several types of companies, including limited liability companies (LLCs) and branch offices. LLCs are the most common type of offshore company in Hong Kong and provide limited liability protection to shareholders. Step 3: Choose a Registered Agent and Address All Hong Kong companies are required to have a registered agent and address in Hong Kong. The registered agent will handle all official correspondence on behalf of the company, while the registered address will be the official address for the company's correspondence. Step 4: Prepare the Required Documents To register an offshore company in Hong Kong, you will need to prepare the following documents: Certificate of Incorporation Articles of Association Business registration certificate Memorandum of Association Incorporation form Identity proof and address proof of directors and shareholders Step 5: Submit the Documents to the Companies Registry Once you have prepared all the required documents, you can submit them to the Hong Kong Companies Registry. The registration process typically takes around 5-7 working days. Step 6: Open a Corporate Bank Account Once your offshore company is registered in Hong Kong, you will need to open a corporate bank account. Hong Kong offers a wide range of banks, including international banks, making it easy to find a bank that meets your business needs. Step 7: Fulfill the Ongoing Compliance Requirements After registering your offshore company in Hong Kong, you will need to fulfill ongoing compliance requirements, including filing annual tax returns, maintaining proper accounting records, and holding annual general meetings.

In Conclusion, registering an offshore company in Hong Kong can be a highly effective strategy for entrepreneurs looking to take advantage of Hong Kong's business-friendly environment and favorable tax system. By carefully following the registration processand fulfilling ongoing compliance requirements, you can establish a successful offshore company in Hong Kong and reap the benefits of increased profitability and growth.

Benefits of Registering an Offshore Company in Hong Kong?

Favorable Tax System Hong Kong has a simple and transparent tax system, with a low tax rate of 16.5%. Hong Kong's tax system is also territorial, which means that companies are only taxed on income generated within Hong Kong. This makes Hong Kong an attractive destination for offshore companies looking to minimize their tax liabilities. Strategic Location Hong Kong's location in the heart of Asia makes it an ideal location for companies looking to expand their business in the region. It is well-connected to other major Asian markets, including China, Japan, South Korea, and Taiwan, making it a gateway to these markets. Business-Friendly Environment Hong Kong is known for its business-friendly policies, which make it easy to do business in the country. The government has implemented measures to simplify company registration and reduce bureaucracy, making it easy for companies to set up and operate in Hong Kong. Efficient Banking System Hong Kong has a highly efficient and stable banking system, which is an essential factor for offshore companies. The city is home to some of the world's largest banks and has an excellent reputation for financial stability. Protection of Intellectual Property Hong Kong has a robust legal system that protects intellectual property rights. The city has enacted laws to protect trademarks, copyrights, patents, and other forms of intellectual property, making it an ideal location for companies that rely on intellectual property. Skilled Workforce Hong Kong has a highly educated and skilled workforce, with a large pool of talent from diverse backgrounds. This makes it easy for companies to find the right talent for their business needs. Access to Funding Hong Kong is a hub for venture capital and private equity investment, with a thriving startup ecosystem. This makes it easy for offshore companies to access funding and grow their business. United Arab Emirates The United Arab Emirates (UAE) has emerged as a leading offshore company formation destination in recent years due to its favorable tax system, business-friendly environment, and strategic location. The UAE does not impose a corporate tax, and there are no personal income taxes, making it an attractive location for businesses and entrepreneurs.

Dubai and Abu Dhabi, the two main commercial centers of the UAE, have modern infrastructure, excellent connectivity, and a highly skilled workforce. The UAE also has a stable political environment and a transparent regulatory framework, making it an easy place to do business.

How to Register an Offshore Company in UAE?

Step 1: Choose a Business Activity and Company Name The first step in registering an offshore company in UAE is to choose a business activity and company name. The business activity must be approved by the UAE government and the company name must not be identical to any existing UAE company name. Step 2: Choose a Registered Agent and Address All UAE offshore companies are required to have a registered agent and address in the UAE. The registered agent will handle all official correspondence on behalf of the company, while the registered address will be the official address for the company's correspondence. Step 3: Prepare the Required Documents To register an offshore company in UAE, you will need to prepare the following documents: Memorandum and Articles of Association Certificate of Incorporation Copy of the passport and address proof of directors and shareholders Power of Attorney Board Resolution Step 4: Submit the Documents to the Appropriate Authority Once you have prepared all the required documents, you can submit them to the appropriate authority in the UAE. The authority will review your application and may request additional documents or information. Step 5: Obtain Necessary Licenses and Permits Depending on your business activity, you may need to obtain additional licenses and permits from the UAE government. These may include a trade license, industrial license, or professional license. Step 6: Open a Corporate Bank Account Once your offshore company is registered in UAE and you have obtained the necessary licenses and permits, you can open a corporate bank account. UAE offers a wide range of banks, including international banks, making it easy to find a bank that meets your business needs. Step 7: Fulfill the Ongoing Compliance Requirements After registering your offshore company in UAE, you will need to fulfill ongoing compliance requirements, including filing annual tax returns, maintaining proper accounting records, and holding annual general meetings.

In Conclusion, registering an offshore company in UAE can be a highly effective strategy for entrepreneurs looking to take advantage of UAE's business-friendly environment and favorable tax system. By carefully following the registration process and fulfilling ongoing compliance requirements, you can establish a successful offshore company in UAE and reap the benefits of increased profitability and growth. It is recommended to consult with a professional advisor to ensure that you meet all the requirements and comply with all the laws and regulations of the UAE.

Benefits of Registering an Offshore Company in UAE?

Tax Benefits One of the most significant benefits of registering an offshore company in UAE is the favorable tax system. Offshore companies registered in the UAE are exempt from corporate and personal income tax, as well as value-added tax (VAT). This makes the UAE an attractive destination for companies looking to minimize their tax liabilities. Strategic Location The UAE is strategically located between Europe, Asia, and Africa, making it an ideal location for companies looking to expand their business in these regions. The country is well-connected to major global markets, with excellent air and sea links, making it easy for offshore companies to access markets and customers. Business-Friendly Environment: The UAE is known for its business-friendly policies, which make it easy for companies to set up and operate in the country. The government has implemented measures to simplify company registration and reduce bureaucracy, making it easy for companies to establish their business in the UAE. Stable Political Environment The UAE has a stable political environment, which is an essential factor for companies looking to establish their business in the country. The government is supportive of foreign investment and has implemented policies to attract businesses to the country. Access to Skilled Labor The UAE has a highly skilled and diverse workforce, with talent from different parts of the world. The country's education system is world-renowned, and many of its graduates are sought after by multinational companies. Offshore companies registered in the UAE can tap into this pool of skilled labor, which can help them operate efficiently and effectively. Modern Infrastructure The UAE has modern infrastructure, including world-class transportation, telecommunications, and utilities. This makes it easy for offshore companies to conduct their business operations smoothly and efficiently. Free Trade Zones The UAE has several free trade zones that offer several benefits for offshore companies. These zones offer 100% foreign ownership, no corporate tax, no import or export duties, and streamlined customs procedures. This makes it easy for offshore companies to conduct their business operations and access markets. Access to Global Markets The UAE has a diversified economy and is home to several industries, including oil and gas, manufacturing, and finance. This provides offshore companies with access to global markets and business opportunities.

Conclusion

In conclusion, Piptan offshore company registration can offer significant benefits to businesses seeking to optimize their tax liabilities, protect their assets, and increase their privacy. However, this process also carries several risks and challenges that businesses must carefully consider before pursuing offshore registration. Regulatory compliance, reputation risks, legal and financial risks, tax risks, and operational risks are among the most significant challenges associated with offshore company registration. Businesses must ensure that they comply with all relevant laws and regulations, carefully manage their reputation, mitigate legal and financial risks, carefully evaluate tax implications, and effectively manage their offshore operations to successfully navigate these challenges. Despite these challenges, many businesses have successfully established offshore companies and taken advantage of the benefits associated with this process. However, businesses must carefully evaluate the potential benefits and challenges of offshore company registration and seek professional advice to ensure that they make informed decisions. Overall, offshore company registration can be a complex and challenging process, but with careful planning and execution, businesses can successfully navigate these challenges and reap the benefits of offshore company registration.

#Offshore Company Registration online#Best Offshore Company formation service#Offshore Company formation With Bank account#Best Country To Set Up An Offshore Company#Offshore company List#Best country For Offshore Company

0 notes

Text

Attestation of Documents and/or Certificates by a Lawyer to Use Them Outside the UAE

To use documents or certificates outside the UAE, it is necessary to attest them by a lawyer. The court lawyers in Dubai will notarize the documents or certificates and will provide a stamped and signed copy. The documents or certificates will then be valid for use outside the UAE.

What is an Attestation of Documents and/or Certificates?

An attestation of documents and/or certificates is verifying a document or certificate by a notary public. The legal support professional will review the document to ensure it is complete and accurate, then will sign and stamp it to provide their certification. This process helps ensure the document's legitimacy and can be used for legal purposes.

What is the Purpose of an Attestation of Documents and/or Certificates?

An attestation of documents is a statement made by a notary public that confirms the authenticity of a document. The notary public will also state that the document was signed in their presence, and that they are familiar with the signer's signature. This attestation is a way to ensure the validity of a document, and can be used for legal purposes.

A certificate is a document that confirms the authenticity of a person, object, or event. Certificates are often used for authentication and can be used as proof of identity or qualifications. Certificates can also be used to show that an event took place, or that a product is authentic.

Who Can Perform an Attestation of Documents and/or Certificates?

An attestation of documents or certificates can be performed by a number of different individuals, depending on the type of document or certificate being attested. For example, an affidavit can be attested by a notary public, while a school or university can attest a diploma. Some organizations also have their own attestation procedures and personnel.

What is the Process of an Attestation of Documents and/or Certificates?

When you need to have a document notarized, the notary will require some basic information from you, such as your full legal name, date of birth, and the document's intended use. The notary will then examine the document to ensure all information is accurate.

After verifying the document, the notary will sign and stamp it with their official seal. This notarization verifies the document's authenticity and correct execution. It also serves as a form of authentication, proving the notary's signature is legitimate.

What are the Requirements of an Attestation of Documents and/or Certificates?

Certain requirements must be met when an individual needs to have a document notarized. The document must be complete and accurate and signed by the individual in the notary's presence. In addition, the document must be originals or certified copies. The legal counsel must also verify the identity of the individual signing the document.

What are the Fees for an Attestation of Documents and/or Certificates?

Fees for an Attestation of Documents and/or Certificates can range from $10 to $100, depending on the country of legalization.

#legal counsel#lawyers in dubai#business setup services in dubai#legal consultants in dubai#best law firm in dubai uae#company formation & business setup in dubai uae#legal consultation in dubai uae#attorneys in dubai#offshore and free zone business setup dubai#pro services in dubai

0 notes

Text

Business setup in Dubai

Business setup in Dubai refers to the process of establishing a business entity within the city of Dubai, which is one of the seven emirates of the United Arab Emirates (UAE). Dubai is a thriving business hub known for its strategic location, robust infrastructure, and business-friendly environment. Here is a detailed explanation of business setup in Dubai:

Mainland Business Setup: Mainland business setup allows businesses to operate within the local market of Dubai and the UAE. It requires partnering with a local Emirati sponsor or a local service agent, depending on the nature of the business activity. The sponsor holds a minority share (typically 51%) in the company, while the majority share can be owned by foreign investors.

Free Zone Business Setup: Free zones in Dubai are designated areas that offer attractive incentives and benefits to businesses. These include 100% foreign ownership, tax exemptions, full repatriation of profits, and simplified procedures. Each free zone in Dubai caters to specific industries or sectors, such as Dubai Multi Commodities Centre (DMCC) for commodities trading, Dubai Internet City (DIC) for technology companies, and Dubai Media City (DMC) for media and advertising companies.

Offshore Business Setup: Dubai also offers offshore company formation through jurisdictions such as JAFZA Offshore and RAK Offshore. Offshore companies are not allowed to operate within the UAE market but are ideal for international business activities, asset holding, or as a vehicle for investment and wealth management. They provide privacy, tax advantages, and ease of administration.

Legal Structures: Dubai offers various legal structures for business setup, including Limited Liability Company (LLC), Sole Proprietorship, Partnership, Branch of a Foreign Company, and more. The choice of legal structure depends on factors such as ownership requirements, liability considerations, and business objectives.

Licensing and Permits: Business setup in Dubai requires obtaining the necessary licenses and permits from the relevant authorities. This includes trade licenses, professional licenses, industrial licenses, and specialized permits based on the nature of the business activity. The requirements vary depending on the type of business and the jurisdiction in which it is established.

Office Space and Infrastructure: Businesses in Dubai need to secure suitable office space or facilities to operate. This can be done through leasing commercial spaces, utilizing shared office spaces, or renting virtual offices. Dubai offers state-of-the-art infrastructure, modern office buildings, and world-class amenities to support business operations.

Visa and Immigration Services: Business setup in Dubai includes visa and immigration services for company owners, employees, and their dependents. This involves obtaining residence permits, work permits, investor visas, and other necessary documents from the Dubai Department of Economic Development (DED) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

Compliance and Regulations: Businesses in Dubai must comply with local regulations, including financial reporting, tax obligations, labor laws, and industry-specific regulations. Compliance requirements vary based on the legal structure and the nature of the business activity. It is important to stay updated with the regulations and engage professional advisors to ensure ongoing compliance.

Dubai offers numerous advantages for businesses, including a strategic location that serves as a gateway to the Middle East, Africa, and Asia, a robust infrastructure, a diverse and multicultural workforce, political stability, and a supportive business ecosystem. However, navigating the business setup process in Dubai can be complex, and it is advisable to seek the assistance of experienced business setup consultants who can guide you through the legal requirements, procedures, and best practices to ensure a successful and compliant business establishment.

#business#business services#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#business setup services in dubai#businessinuae#businesssetup#businesssetupdubai

8 notes

·

View notes

Text

Unlocking Success: Embrace the Best Pro Services in Dubai with 365 PRO Services

Welcome to 365 PRO Services, Your Reliable Partner for a Simplified UAE Business Setup! Embark on your entrepreneurial journey with confidence, courtesy of 365 PRO Services – the latest powerhouse in UAE's PRO Services and business setup consultancy scene. We specialize in guiding you seamlessly through a myriad of services, approvals, and paperwork, ensuring you sail through the setup phase without a hitch.

Why Dive into the World of Business Pro Services?

Efficiency at Its Finest: Wave goodbye to time-consuming administrative tasks. Our streamlined processes are designed to save you time and resources, allowing you to focus wholeheartedly on propelling your business forward.

Expertise That Speaks Volumes: With an extensive understanding of UAE regulations and strong connections with government bodies, our proficient team ensures professionalism and confidentiality every step of the way.

Comprehensive Solutions: From handling paperwork to obtaining licenses, we've got you covered. Whether it's LLC company formation, Free zone setups, or visa facilitation, we provide holistic solutions tailored to your needs.

Embarking on your business journey in Dubai? Partnering with our PRO Services guarantees a smooth ride, devoid of complexities. We value your time and offer an array of PRO services to ease your administrative burdens.

Explore Our Range of Services:

• Effortless LLC company formation

• Agile Free zone and offshore setups

• Seamless trade license management

• Swift family and employment visa facilitation

• Hassle-free company closure assistance

Why Choose Us?

Our seasoned Business PRO team is dedicated to managing your business documentation with finesse. We navigate through regulatory mazes, working closely with esteemed entities like the Department of Economic Development (DED) and Dubai Immigration (AMER) to ensure a seamless experience.

Creating a business should bring about feelings of excitement, rather than being a daunting task. Let us take the reins while you steer your business towards unprecedented success.

Experience efficiency, expertise, and excellence like never before with us. Bid adieu to administrative woes and embark on a journey towards triumph in the dynamic UAE market. Count on our team to navigate the complexities while you dedicate your attention to transforming your entrepreneurial visions into actuality. With our PRO Services, conquering the Dubai business landscape is not just a dream—it's your reality waiting to unfold!

#365PROServices#DubaiBusiness#BusinessSetup#Entrepreneurship#DubaiEntrepreneurs#Success#Streamlined#BusinessConsultancy#DubaiBusinessSetup#BusinessGrowth#PROServicesUAE#proservices#uaevisaservices#businesssetupdubai#businesssetupuae#uaeconsultancy

4 notes

·

View notes

Text

Company Formation in UAE with Dhanguard | Expert Business Setup Services

Looking for a company formation in uae? Dhanguard offers expert guidance to help you establish a successful business in this dynamic market. The UAE provides a robust business environment with tax benefits, strategic location, and a diverse economy, making it an ideal destination for entrepreneurs. Whether you’re interested in a free zone company, a mainland entity, or offshore registration, Dhanguard’s team of professionals ensures a seamless company formation process. We handle everything from legal paperwork to visa processing, making your setup quick and hassle-free. With our deep understanding of local regulations and industry best practices, Dhanguard helps you navigate the complexities of company formation in the UAE. Start your business journey today with Dhanguard and unlock opportunities in one of the world’s fastest-growing economies! https://dhanguard.com/company-formation-dubai-uae

0 notes

Text

Register Your Company in Gibraltar: A Strategic Choice

Gibraltar, with its robust economy and strategic location at the crossroads of Europe and Africa, has become a prime destination for entrepreneurs and businesses looking to establish a presence offshore. Known for its favorable business environment, transparent regulations, and tax advantages, Gibraltar is an excellent choice for company registration.

Why Register a Company in Gibraltar?

Tax Benefits: Gibraltar offers attractive tax policies, including a low corporate tax rate of 12.5% and no capital gains tax, wealth tax, or VAT.

EU Access: As a British Overseas Territory, Gibraltar maintains close ties with the UK, providing businesses access to EU markets under specific agreements.

Political Stability: The territory boasts a stable government and a well-regulated financial sector, ensuring a secure business environment.

Efficient Incorporation Process: Registering a company in Gibraltar is straightforward, with clear guidelines and relatively short processing times.

Strong Financial Services Sector: Gibraltar is home to a thriving financial services industry, including banking, insurance, and investment management, offering businesses access to excellent professional support.

Steps to Register a Company in Gibraltar

Choose Your Business Structure: Decide on the type of company—Limited Company (LTD), Partnership, or Sole Proprietorship—that best suits your business needs.

Name Your Company: Ensure the name is unique and complies with Gibraltar’s naming regulations.

Submit Required Documents: These typically include the Memorandum of Association, Articles of Association, proof of identity, and address for the directors and shareholders.

Appoint a Company Secretary: Every company in Gibraltar must have a qualified company secretary.

Register for Tax and Licenses: Apply for a Tax Identification Number (TIN) and obtain any necessary business licenses for your operations.

Benefits of Choosing Atrium Associates for Your Gibraltar Company Registration

At Atrium Associates, we specialize in offshore company formation, including comprehensive services for registering your business in Gibraltar. Our expert team will guide you through the entire process, from document preparation to compliance and beyond. We provide:

Tailored solutions to meet your specific needs.

Assistance with opening a corporate bank account in Gibraltar.

Continued support for regulatory compliance and tax filing.

Start Your Business Journey Today

Whether you're a startup, an expanding business, or an investor seeking tax efficiency, Gibraltar is a gateway to global opportunities. Let Atrium Associates handle the complexities of company registration while you focus on growing your business.

Contact us www.atrium-associates.com today to get started!

0 notes

Text

Advocate in Dubai At Aljasmi Law, we have a team of dedicated and best advocates in Dubai and legal consultants in Dubai to provide the soundest advice to our clients. We have a rich area of expertise and offer our services to tackle professional issues, rental conflicts, property matters, banking solutions, the formation of new companies in Dubai, and offshores. https://www.aljasmilaw.com/consultant-lawyer.aspx

0 notes

Text

Best Business Setup Consultants in Dubai

Helen and Sons provide professional Business consultancy. We are one of the most reliable consultancies in the UAE. Helen and Sons are the Top Best Business Setup Consultants in Dubai having a massive bank of experience in offering reliable Business Setup in free Zone, mainland in UAE, LLC company formation in UAE, offshore company formation in Dubai, and other emirates of UAE. Being one of the reputable firms offering business consultancy services in UAE, we proudly flaunt our authorized premium partnership with all free zones in UAE.

Website: https://helensons.ae/Address: Dubai Islamic Bank - C Block, 2nd Floor - Al Zahra'a St - Al Nad - Al Qasimia - Sharjah Postal Code : 500001

1 note

·

View note

Text

Offshore company formation involves establishing a business entity in a foreign jurisdiction, often for reasons such as tax optimization, asset protection, and ease of international trade. Here’s a structured overview of the process, key considerations, and popular jurisdictions for setting up an offshore company.

0 notes

Text

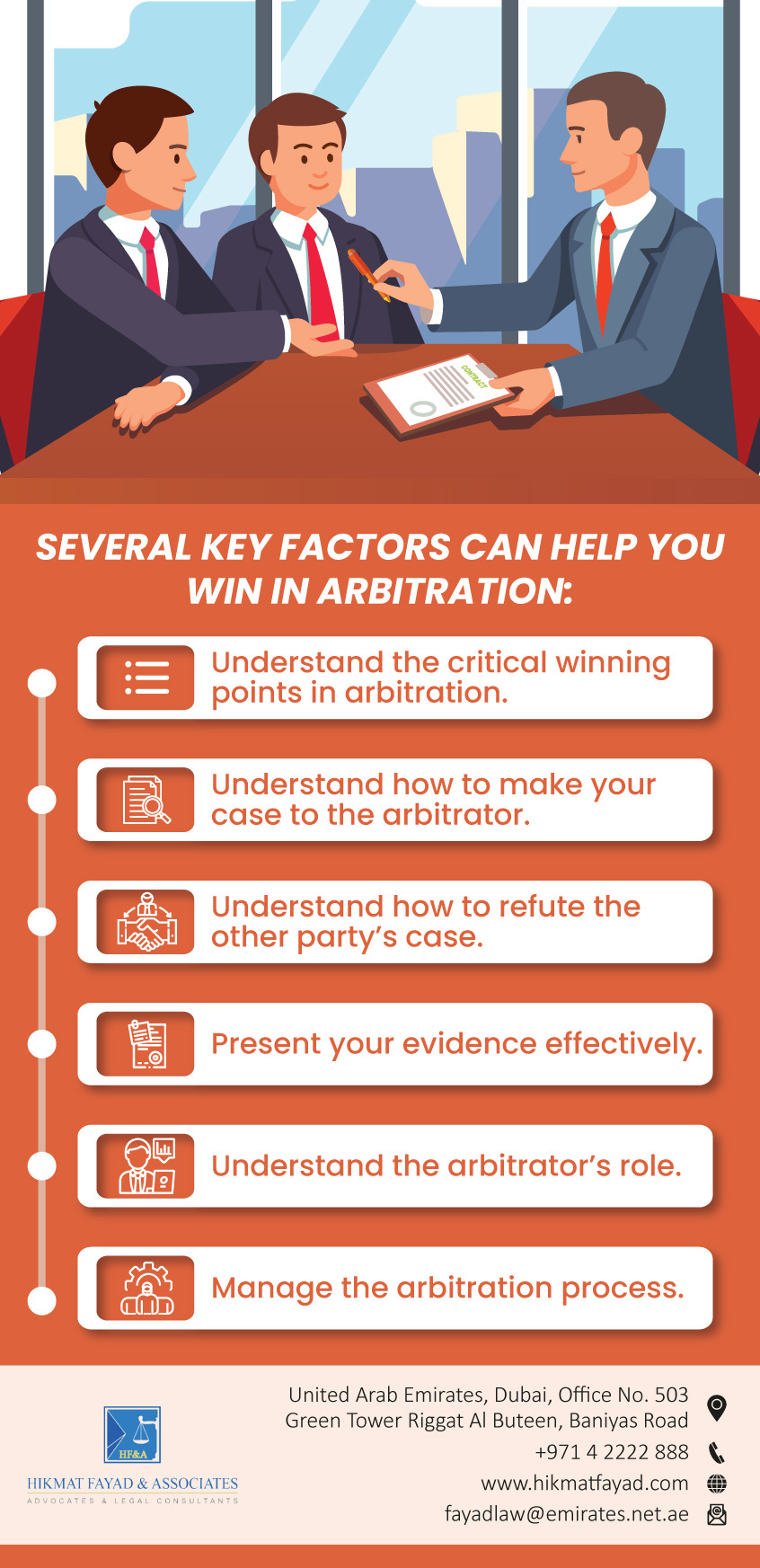

Hikmat Fayad - Professional Arbitration in Dubai

#legal consultation in dubai uae#legal consultants in dubai#legal counsel#Business setup services in dubai#Company formation & business setup in dubai uae#offshore and free zone business setup dubai#PRO services in dubai#best law firm in dubai uae#lawyers in dubai#attorneys in dubai#legal mediation services#professional mediation services#arbitration in dubai#professional arbitration in dubai#litigation advocate#legal support professional#civil and commercial lawyer#corporate lawyer#court lawyers in dubai#rental disputes lawyers

0 notes

Text

business setup consultants dubai

At Ansaar business setup consultants dubai, we focus on delivering bespoke solutions tailored to your unique business requirements. With our comprehensive service offering, you can focus on growing your business while we handle the administrative and legal complexities.

Company Formation & Registration: We business setup consultants in uae assist you in setting up your business in the UAE, ensuring compliance with local laws and regulations. Whether you’re looking to establish a Mainland, Free Zone, or Offshore company, we provide expert guidance on the most suitable structure for your business.

Trade License Issuance: We help you obtain the necessary trade license for your business activity, facilitating a smooth and quick process to get your operations up and running.

PRO Services: We offer a range of Government Liaison (PRO) services to help you navigate the complexities of local regulations, ensuring that all documents are processed quickly and efficiently.

Visa & Immigration Services: Our team assists with visa applications for employees, partners, and family members, as well as residency permits, ensuring compliance with UAE’s immigration laws.

Corporate Banking: We facilitate the opening of corporate bank accounts, providing expert advice on the best banking options available in the UAE based on your business needs.

Office Space Solutions: We offer flexible office space options, whether you need a virtual office, co-working space, or private office. Our solutions cater to businesses of all sizes.

Accounting & Bookkeeping: Our financial experts provide accounting and bookkeeping services to ensure your business remains compliant with the UAE’s tax and financial regulations.

Marketing & Branding: We assist businesses in developing effective marketing strategies, including branding, digital marketing, and advertising, to boost visibility and grow your presence in the UAE market.

Renewals & Ongoing Compliance: We help with the timely renewal of your trade license, visas, and other legal documentation, ensuring that your business remains compliant with UAE laws and regulations at all times.

0 notes

Text

Why Offshore Company Registration is a Smart Move for Tax Efficiency?

Globalisation has made it easier for businesses to expand beyond borders, explore new markets, and optimise their operations. Among the strategies employed by savvy entrepreneurs, offshore company registration stands out as a powerful tool for achieving tax efficiency. In this blog, we’ll explore the benefits of offshore company registration, how it enhances tax efficiency, and why it might be the right choice for your business.

What is Offshore Company Registration?

Offshore company registration refers to the incorporation of a business in a country other than where the owner resides or primarily conducts business. Countries that offer favourable tax regimes, streamlined company formation services, and business-friendly regulations are popular for offshore company formation.

Benefits of Offshore Company Formation

The process of forming an offshore company is relatively simple and fast, that is why businesses opt for registering the company online within these jurisdictions. Platforms such as EuroCompanyFormations make it even easier to establish an offshore company and manage compliance smoothly.

Tax Efficiency :- One of the major reasons for registering an offshore company is to save on huge tax benefits. Most of the jurisdictions, commonly known as tax havens, provide a lower or even nil corporate tax rate. For instance, if you register a company in Europe, especially in Ireland or Malta, you can enjoy some pretty good corporate tax rates, double taxation treaties, and in some cases, exemption on foreign income.

Asset Protection :- Offshore companies provide a degree of legal separation between personal and business assets, thus offering protection against lawsuits and creditors.

Ease of Management :- Modern company formation services enable you to set up and manage your business remotely. Many providers offer solutions to register a company online, thus making the process hassle-free for business owners. Access to Global Markets :- You can reach international markets easily with an offshore company. This is particularly helpful when you are planning a global company formation strategy to expand your business operations.

Offshore Company Registration and Tax Efficiency

How Does It Work?

Tax efficiency via offshore companies doesn't imply tax evasion but rather the strategic use of legal frameworks by certain jurisdictions to reduce your tax burden.

For instance: Low Corporate Tax Rates: Countries like Ireland offer competitive rates to attract businesses interested in beginning a European company. Tax Treaties: Most jurisdictions have double taxation agreements that ensure a business may maximise profits without getting taxed on the same income twice. Exemptions on Foreign Income: Some offshore jurisdictions tax no income that arises outside the borders of that jurisdiction; hence, the ideal business for such locations is international clients.

Choosing the Right Jurisdiction

The best location for offshore company formation is very important. The most popular options include:

Ireland: This is ideal for those who want to register a company in the EU because of its low corporate tax rate and a strong economy. Cyprus: It is famous for its tax policies and strategic location. The Cayman Islands: This is a go-to place for zero corporate tax.

The Process to Register a Company Online

It is now easier than ever to set up an offshore company. Through EuroCompanyFormations and similar platforms, you can now easily tackle everything, from incorporation to compliance.

Here's a step-by-step guide:

Select Your Jurisdiction :- You should research and select a country best suited for your business. Some of the factors include tax rates, regulatory requirements, and how easy it is to do business there. Engage Professional Services :- Seek a reliable firm providing the company formation service so as to ensure you get all done with little or no hassle. Gather documentation:- Provide all the necessary documents in terms of proof of identity, address, and business details with the preferred jurisdiction. Completing registration:- Once granted, your offshore company will be available to operate. Most service providers have systems to guide you on how to handle any compliance matters remotely.

Forming an Offshore Company in Europe

Europe is still in a position where offshore registration is highly regarded due to the economic stability, tax regimes, and ease of doing business. Upon registering a company in Europe, you would have access to the world's largest single market and the best legal framework.

Why Do You Prefer European Company Formation?

EU Memberships: Any business is entitled to membership of 27 member states with zero trade barriers over and above such registration. Diverse Options: Whether you would like to register a company in the EU with low taxes or to expand globally, Europe offers options like Ireland, Luxembourg, and Estonia.

Who should consider offshore company registration?

Offshore company registration is not just for multinational corporations; it is also suitable for:

Startups: Looking to begin a European company and obtain international funding.

Freelancers: Who wants to optimize tax liabilities while working across borders? E-commerce Businesses: Expanding operations into several jurisdictions.

Myths About Offshore Companies Offshore companies have a lot of misconceptions. Let's debunk some of these common myths:

It's Illegal: Offshore company registration is perfectly legal if done transparently. It's Only for Large Corporations: Small businesses and individuals can also take advantage of offshore structures. It's Expensive: Many jurisdictions provide low-cost solutions for registration and compliance.

Conclusion

It is one of the strategic moves towards achieving tax efficiency, protection of assets, and an expansion abroad by offshore company registration. Register a company online easily by availing services of company formation companies such as EuroCompanyFormations, allowing you to concentrate on your business growth. Whether you aim to start a European company, explore worldwide company formation, or simply optimise your tax liabilities, the right offshore strategy can unlock a world of opportunities. Take the first step today and secure a brighter, more profitable future for your business.

#OffshoreCompanyRegistration#TaxEfficiency#CompanyFormationServices#RegisterCompanyOnline#WorldwideCompanyFormation#EuropeanCompanyFormation#StartABusiness#FormACompanyInEurope#BusinessExpansion#GlobalEntrepreneurs#TaxOptimization#OffshoreBusiness#RegisterCompanyInEU#BusinessGrowth#InternationalBusiness

1 note

·

View note

Text

Why Seychelles Is the Best Choice for Offshore Company Formation

Enterprise Development in Seychelles: A Strategic Option for International Business people Seychelles, a lovely island nation while in the Indian Ocean, happens to be a well known option for Global corporations searching for an offshore jurisdiction that offers overall flexibility, favorable tax procedures, as well as a streamlined incorporation procedure. Its position as being a tax haven with minimum regulation and sturdy confidentiality guidelines can make it a sexy place for entrepreneurs all over the world. Whether or not You are looking to create a Keeping enterprise, an expense firm, or interact in international trade, Seychelles presents a fantastic System to support your online business functions.

For more information on the entire process of https://offshorecompanyregister.com, a variety of company constructions, and the key benefits of incorporating In this particular well known offshore jurisdiction, you may explore committed methods and expert products and services available. Seychelles provides a variety of advantages, like tax exemptions, confidentiality, and simplicity in creating an international business enterprise.

Benefits of Seychelles Business Development Seychelles provides a host of Gains that make it considered one of the preferred offshore jurisdictions on earth. The crucial element advantages include:

Tax Performance: Seychelles is noted for its very favorable tax regime. There's no money gains tax, inheritance tax, or revenue tax on earnings acquired outside of Seychelles. This can make it specifically desirable for Intercontinental investors and business owners looking for to enhance their tax liabilities.

Confidentiality: Seychelles has powerful privacy protections for business people. The names of administrators and shareholders will not be publicly disclosed, ensuring that people today can retain a substantial degree of confidentiality pertaining to their money affairs. This level of privacy is ideal for many who want to safeguard their particular and company details.

Ease of Incorporation: Establishing a company in Seychelles is a comparatively quick and straightforward procedure. The state has an easy and successful system that allows most companies for being included in only 1-two times. This enables business owners to begin functions swiftly without the need of handling complicated authorized strategies.

No Exchange Controls: Seychelles has no foreign exchange controls, allowing corporations to freely transfer money out and in on the nation. This versatility is especially helpful for Global businesses that will need to move funds across borders for investment or investing functions.

World-wide Status: Seychelles is recognized being a trustworthy offshore jurisdiction by using a stable authorized framework and adherence to Intercontinental expectations. Companies incorporated in Seychelles take pleasure in a globally identified legal procedure that improves their believability while in the international market.

Offshore Organization Development in Seychelles: The method Offshore Organization Formation in Seychelles is a comparatively very simple process that may be completed with minimum paperwork. The commonest form of enterprise formed in Seychelles is definitely the Worldwide Business enterprise Business (IBC), and that is particularly suitable for non-resident business owners engaged in Global trade or financial commitment pursuits.

Here's a stage-by-move breakdown on the offshore company formation approach in Seychelles:

Pick a firm Name: Step one is to pick out a singular title for the organization. It must comply with Seychelles' naming regulations, ensuring it does not resemble the names of present corporations or involve limited text (including "financial institution" or "insurance plan" Except approved).

Pick a Registered Agent: All organizations in Seychelles are required to appoint a certified registered agent to aid the incorporation process. This agent will manage all vital authorized and administrative jobs, such as publishing files to your Seychelles Financial Expert services Authority (FSA).

Prepare and File the Essential Files: Another step will involve preparing the mandatory files, such as the Memorandum and Content articles of Association, which outline the corporate's purpose, framework, and operational pointers. The names of the administrators and shareholders, together with their identification aspects, must also be included in the submitting.

Incorporation and Certification: When the documentation is submitted and authorized from the FSA, the corporation will receive an official Certification of Incorporation, which confirms the business's lawful existence in Seychelles. This certificate is typically issued in just 1-2 days.

Open a company Banking account: Soon after incorporation, the corporation will need to open a corporate checking account. This can be performed with a local Seychelles financial institution or a world banking establishment. A company banking account is needed for conducting money transactions, the two domestically and internationally.

Seychelles Corporation Incorporation: Critical Factors Seychelles firm incorporation provides overall flexibility and simplicity, making it an desirable option for foreign business people. The most popular organization sort, the IBC, is suitable for Individuals engaged in things to do outside of Seychelles, which allows for entire exemption from Seychelles profits tax on overseas earnings.

Other crucial things to consider for anyone seeking to incorporate in Seychelles incorporate:

Least Requirements: An IBC in Seychelles needs at least a single director and a single shareholder, the two of whom is usually persons or corporate entities. Directors and shareholders could be non-residents, enabling for total Global possession and Regulate.

Yearly Compliance: Even though you will discover small regulatory needs, offshore businesses in Seychelles need to adjust to basic annual filing obligations, like keeping a registered Workplace in Seychelles, publishing yearly economical statements, and retaining business information up-to-date.

Company Overall flexibility: Seychelles makes it possible for organizations to interact in a wide range of organization actions, such as holding property, international trade, e-commerce, and financial investment functions. The jurisdiction is particularly common for asset security and prosperity management on account of its robust authorized frameworks.

Seychelles Offshore Firm: Ideal for Intercontinental Business A Seychelles offshore business is a wonderful motor vehicle for Intercontinental enterprise functions. Whether or not You are looking to hold assets, carry out cross-border trade, or establish an on-line small business, Seychelles gives a lovely setting that minimizes taxes and provides a large standard of privateness and suppleness.

Some of the most common makes use of for Seychelles offshore organizations contain:

Asset Safety: Seychelles organizations are usually used to keep precious assets for instance housing, intellectual home, or investments. The jurisdiction's solid asset safety rules enable protect assets from prospective authorized promises or liabilities.

Global Trade and E-Commerce: Business owners engaged in Intercontinental trade, on the net services, or electronic enterprises can take pleasure in Seychelles' tax exemptions and simplicity of enterprise development. The jurisdiction presents a stable and efficient foundation for controlling worldwide functions and facilitating cross-border transactions.

Expense Keeping: Many investors use Seychelles offshore companies to hold shares in foreign organizations, real-estate investments, or other money assets. The shortage of taxation on international revenue will make Seychelles a sexy locale for international financial investment procedures.

Conclusion Firm formation in Seychelles delivers a pretty selection for corporations seeking to reap the benefits of a favorable tax regime, robust privateness protections, and also a simplified incorporation system. Regardless if you are creating a holding organization, participating in international trade, or in search of asset protection, Seychelles presents a versatile and productive ecosystem for a variety of organization actions. With its secure legal framework, trustworthy economical solutions, and nominal regulatory hurdles, Seychelles proceeds to get among the primary offshore jurisdictions for business owners worldwide. For more facts on the process of offshore enterprise formation in Seychelles, stop by Organization Development in Seychelles.

0 notes

Text

Cost of Company Formation in UAE: Affordable Solutions with Dhanguard

The cost of company formation in UAE can vary depending on several factors, such as the type of company, location, and business activity. Dhanguard offers transparent pricing and customized packages to suit your business needs. Whether you're setting up in a Free Zone, Mainland, or Offshore, we provide clear cost breakdowns for licenses, visas, office space, and other essential services. While Free Zone companies tend to have lower setup costs, Mainland companies offer more flexibility in terms of market access. Dhanguard helps you navigate the cost structure, ensuring you get the best value for your investment. We offer end-to-end services, from initial consultation to final registration, making the process efficient and cost-effective. With Dhanguard, you can be confident that your company formation in the UAE will be handled professionally, at a competitive price, while ensuring full compliance with local regulations. https://dhanguard.com/

0 notes

Text

Simplify Company Registration in Dubai with StartanIdea

Dubai is a thriving business hub that attracts entrepreneurs from around the globe. Whether you're looking to tap into local markets or use Dubai as a gateway to international trade, registering a company here offers numerous advantages. However, the process can be complex and daunting without the right guidance. Dubai business registration requirements StartanIdea is your trusted partner, providing comprehensive services to streamline the company registration process in Dubai. Discover how our expertise can help you establish your business swiftly and efficiently, ensuring compliance with all legal requirements.

Why Choose StartanIdea for Company Registration in Dubai?

1. Expert Guidance

Navigating the legal and regulatory landscape in Dubai can be challenging. StartanIdea's team of seasoned professionals has extensive experience in company formation and can provide you with expert advice tailored to your business needs. We help you understand the various business structures and guide you in choosing the one that best suits your goals.

2. Comprehensive Services

From the initial consultation to the final registration, StartanIdea offers a full suite of services to ensure a smooth and hassle-free process. Our services include business name registration, obtaining necessary licenses, and setting up bank accounts. We handle all the paperwork and liaise with government authorities on your behalf.

3. Customized Solutions

Every business is unique, and so are its registration needs. StartanIdea provides customized solutions tailored to your specific requirements. Whether you're setting up a mainland company, free zone entity, or offshore business, we ensure that your registration aligns with your strategic objectives.

4. Efficient Process

Time is of the essence when starting a new business. StartanIdea is committed to providing a quick and efficient registration process, minimizing delays and ensuring that your company is up and running in no time. Our streamlined procedures and proactive approach help you meet your business goals faster.

5. Post-Registration Support

Our support doesn't end with company registration. StartanIdea offers ongoing assistance to help you navigate the initial stages of your business operations. From visa processing to legal compliance and annual renewals, we provide continuous support to ensure your business runs smoothly.

Steps to Register a Company in Dubai with StartanIdea

Initial Consultation: Contact StartanIdea for an initial consultation to discuss your business idea and objectives. We assess your needs and provide personalized recommendations.

Business Structure Selection: Choose the appropriate business structure, such as a Limited Liability Company (LLC), Free Zone Company, or Offshore Company. Our experts help you select the structure that best suits your requirements.

Name Reservation: Select a unique name for your company and reserve it with the Department of Economic Development (DED) or relevant Free Zone Authority.

Document Preparation: Prepare the necessary documents, including the Memorandum of Association (MoA) and Articles of Association (AoA). Our team ensures that all documentation is accurate and complete before submission.

License Application: Apply for the required business licenses based on your chosen business activities. StartanIdea handles the entire application process, ensuring compliance with all regulatory requirements.

Registration Submission: Submit the complete registration application along with the required documents to the relevant authorities. StartanIdea follows up to expedite approval.

Post-Registration Assistance: Once your company is registered, we assist with post-registration activities, such as opening bank accounts, obtaining visas, and setting up office space.

Get Started with StartanIdea

Embark on your entrepreneurial journey in Dubai with confidence and ease. StartanIdea is your trusted partner for company registration, offering expert guidance, comprehensive services, and customized solutions. Professional company registration in Dubai Visit our website or contact us today to learn more about how we can help you establish and grow your business in Dubai. Trust StartanIdea to make your company registration experience seamless and successful.

0 notes

Text

Offshore Company Formation: Unlocking Global Business Opportunities

Setting up an offshore company is a strategic move for businesses and individuals seeking financial flexibility, global reach, and tax efficiency. At TBA Associates, we specialize in guiding entrepreneurs and investors through the intricate process of offshore company formation, ensuring compliance, transparency, and optimized benefits.

What Is Offshore Company Formation?

Offshore company formation refers to the establishment of a business entity in a foreign jurisdiction, typically in a country or territory with favorable tax laws, business regulations, and privacy policies. These companies often serve as holding entities, asset protection vehicles, or international trade hubs.

Key Advantages of Offshore Company Formation

Tax Optimization

Enjoy reduced tax rates or complete exemptions in many offshore jurisdictions.

Benefit from double taxation treaties between countries.

Asset Protection

Safeguard assets from legal disputes or domestic financial risks.

Maintain confidentiality with strong privacy laws in offshore jurisdictions.

Global Business Expansion

Operate seamlessly across borders without restrictions.

Tap into emerging markets and new business opportunities.

Ease of Administration

Benefit from simplified reporting requirements and flexible corporate regulations.

Enhanced Privacy

Offshore jurisdictions often protect business and shareholder information.

Improved Access to Capital

Open doors to international banking, loans, and investment opportunities.

Popular Offshore Jurisdictions

British Virgin Islands (BVI): Known for its simplicity and tax neutrality.

Cayman Islands: A premier choice for hedge funds and investment firms.

Delaware, USA: Ideal for startups and corporations seeking legal protection.

Hong Kong: A gateway to the Asian market with robust infrastructure.

Cyprus: Offers low corporate taxes and EU market access.

How TBA Associates Simplifies Offshore Company Formation

Jurisdiction Selection:

Help you choose the best location based on your business goals.

Company Registration:

Handle all paperwork, legal requirements, and compliance measures.

Bank Account Setup:

Assist with opening offshore corporate bank accounts for seamless operations.

Tax and Legal Advice:

Provide expert guidance on international tax laws and asset management.

Ongoing Support:

Offer post-formation services, including accounting, reporting, and compliance.

Myths About Offshore Companies

“Offshore companies are illegal.” Offshore companies are legitimate business structures used worldwide. Misuse leads to misconceptions.

“Only the wealthy benefit from offshore companies.” Businesses of all sizes can benefit from offshore setups, not just high-net-worth individuals.

The Future of Offshore Company Formation

The landscape of offshore businesses is evolving with:

Enhanced Transparency: Jurisdictions are adopting international standards for compliance.

Digital Solutions: Remote management of offshore entities is becoming easier with technology.

Eco-Friendly Initiatives: Jurisdictions are incentivizing businesses that promote sustainability.

Contact TBA Associates

For tailored offshore company formation services, TBA Associates is your trusted partner. Our expertise and commitment ensure a seamless experience as you navigate the complexities of global business structures.

1 note

·

View note